1X Short VeChain Price Chart (VETHEDGE/USD)

Last updated 22 Jun 2022, 09:11AM UTC. Currency in USD.

VETHEDGE Price Statistics

-

1X Short VeChain Price Now

$113

-

24h Low / 24h High

$112 / $113

-

Trading Volume

$114

-

Market Cap Rank

#0

-

Market Cap

$0

-

Volume / Market Cap

0.0000

-

All-Time High

$8,053 -98.60%

Nov 06, 2020

-

All-Time Low

$35 217.35%

Nov 09, 2021

Most Visited Cryptocurrencies

1X Short VeChain Cryptocurrency

Introduction

VeChain is a prominent blockchain platform that aims to enhance supply chain management and business processes. As with any investment, cryptocurrencies come with their fair share of risks and potential rewards. In this article, we will delve into the concept of 1X Short VeChain cryptocurrency and investigate its implications in the market.

Understanding 1X Short Cryptocurrency

To comprehend 1X Short VeChain cryptocurrency, it is vital to grasp the concept of shorting. Shorting involves speculating on the decline of a specific asset or security. This trading strategy allows investors to profit from market downturns, providing an opportunity to make money even in a bearish market. In the context of VeChain, 1X Short means that the investor is betting on a decline in the value of VeChain cryptocurrency.

Pros and Cons

Like any investment product, there are pros and cons associated with 1X Short VeChain cryptocurrency. Let's examine a few of these below:Pros:- Hedging: Investors who already hold VeChain tokens can use 1X Short VeChain cryptocurrency to hedge against potential losses. This strategy can help mitigate risk in case the price of VeChain falls.- Diversification: Shorting VeChain cryptocurrency allows investors to diversify their portfolios by gaining exposure to both sides of the market, long (betting on price increase) and short (betting on price decline). This diversification can help balance the risk and enhance potential returns.Cons:- Market Volatility: The cryptocurrency market is well-known for its volatility, and shorting cryptocurrencies can be even riskier. Prices can fluctuate rapidly, and incorrect predictions may lead to substantial losses. It is crucial to thoroughly analyze the market and make informed decisions before engaging in short selling.- Potential Unlimited Losses: While the profit potential of short selling can be high, it is important to note that losses can also be limitless. Unlike buying and holding, shorting exposes investors to the possibility of exponential losses if the market moves against their prediction. Proper risk management is essential to minimize potential damages.

Conclusion

1X Short VeChain cryptocurrency offers investors the opportunity to profit from the potential decline in the value of VeChain tokens. However, this trading strategy carries inherent risks, especially given the volatile nature of the cryptocurrency market. It is crucial for investors to conduct thorough research, understand market trends, and make well-informed decisions before engaging in short selling. Only by carefully assessing the pros and cons can investors effectively navigate the world of 1X Short VeChain cryptocurrency and potentially capitalize on its benefits.

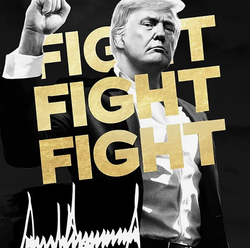

Official Trump (TRUMP)

Official Trump (TRUMP) WETH (WETH)

WETH (WETH) Hyperliquid (HYPE)

Hyperliquid (HYPE) Pump.fun (PUMP)

Pump.fun (PUMP) Axie Infinity (AXS)

Axie Infinity (AXS) Lombard Staked BTC (LBTC)

Lombard Staked BTC (LBTC)